Humboldt County Supervisors Adjust Cannabis Tax Billing to Ease Grower Finances

- CannaNews.Buzz

- Mar 22, 2019

- 2 min read

Humboldt County cannabis growers will no longer be billed for excise tax payments just after receiving their permits, a change that may lighten grower expenses but strike a blow to the county’s tax revenue.

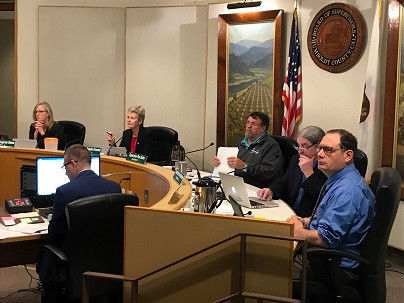

Growers will be billed in January for payments due March 15 and October 15 of that year, while the tax itself will go into effect on the day a grower has plants on site, according to decisions approved by the county Board of Supervisors at its meeting today.

“We’ve heard from a lot of people — especially in this transitional phase of the industry — that they did not have an opportunity to sell their product on the market and have the finances to pay the taxes,” 2nd District Supervisor Estelle Fennell told the Times-Standard this afternoon.

According to a county staff report, cannabis growers had shared concerns with the county over the previous billing process. Growers who were hit with the tax right away often did not yet have their operations up and running, which meant they couldn’t pay their taxes.

Other operations active during the year’s dryer months were being taxed without producing grows.

The change will go into effect immediately. Added to the supervisors’ approval was flexibility for the Planning and Building department to reduce the square footage tied to a cannabis grow if the grower successfully petitions it.

Terra Carver, executive director of the Humboldt County Growers Alliance, commended the board’s decision.

“This industry is struggling with overtaxation on the state level and today’s vote provides relief and greater flexibility on the local level,” Carver said. “The goal is to create a sustainable revenue stream from Measure S, to benefit the entire county.“

While the main change-up means growers will have less of a tax burden, it may also reduce the county’s revenues. In a text message, county spokesperson Sean Quincey estimated the decision will reduce tax revenue by $8 million this year.

A loss in revenue may also affect Project Trellis, a major program adopted by the board this month to reinvest tax revenues into a program to assist growers.

“It will have somewhat of an effect on Project Trellis, but it will hopefully be able to stabilize the complete cannabis industry,” Fennell said. “If the industry could stabilize, we could have a more reliable and dependable revenue stream in the future if those businesses are successful.”

“These are the people who are coming into compliance under very challenging circumstances,” Fennell continued. “We want to support them and give them a chance to be successful.”

Comments